The Fate of Nations Is Squared: Where capacity to generate, not capacity to compute, determines destiny

Executive Summary

Across six nations, the AI race collides with a deeper constraint: chips scale ideas, but grids scale reality. The United States holds unmatched semiconductor power yet faces a paralyzed transmission network. China, under embargo, surges ahead through ultra-high-voltage expansion. Europe optimizes energy it doesn’t control. Japan and South Korea perfect reliability but remain electricity islands. The Gulf turns abundance into server space, not innovation. Argentina reforms upstream while its cities dim downstream.

These paradoxes defy GDP, chip counts, or electricity prices. Three laws emerge instead: nations that built first now build slowest; import dependence imposes a ceiling; and institutional speed drives either breakthrough or collapse. Together they reveal a squared relationship between energy sovereignty and technological capability. In the end, the future of AI will hinge less on who builds the fastest chips than on who commands the most autonomous flow of electrons. The fate of nations—and their intelligences—will be squared.

1: Six Puzzles in Plain View

United States: Panic at the Top

September 2024. Microsoft commits $1.6 billion in a power purchase agreement supporting Constellation Energy's plan to restart Three Mile Island Unit 1—the same facility that became synonymous with nuclear anxiety in 1979. The same month, Amazon pays $650 million for a data center in Pennsylvania, not for the building, but for its direct connection to the Susquehanna nuclear plant.

These aren't expansion deals. They're survival moves.

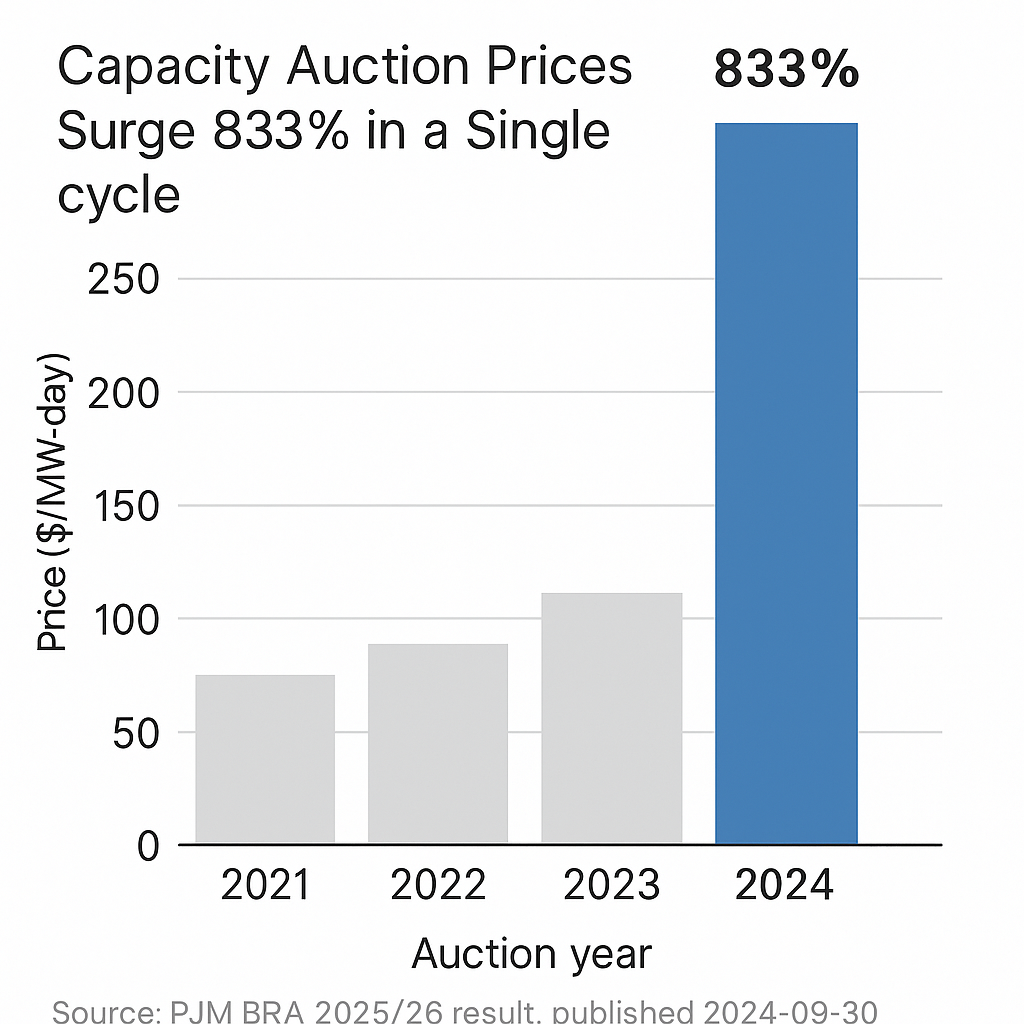

PJM Interconnection, the grid operator serving 65 million Americans across thirteen states, watched its capacity auction prices detonate from $28.92 to $269.92 per megawatt-day. Not a 20% increase. Not even double. An 833% spike in a single auction cycle. Virginia's data center corridor—where 70% of global internet traffic flows—now has 8 GW of projects waiting for grid access against 3.5 GW of existing capacity. Average wait time: seven years.

The United States controls more AI chip capacity than the rest of the world combined. Its companies built 34 of the top 40 AI models. Its data centers host 53.7 GW of computing infrastructure—more than China, Europe, and Japan combined. Yet its tech giants are behaving like refugees fleeing a collapsing state, throwing billions at any facility that can guarantee electrons.

Why is the chip king terrified?

China: The Sanctioned Sprinter

China operates under the most comprehensive technology embargo since the Cold War. ASML's EUV lithography machines—required for cutting-edge chips—are banned. Nvidia's H100 GPUs are banned. Even advanced packaging technologies face restrictions. By every measure of semiconductor capability, China should be crawling.

It's not.

The "East Data, West Computing" strategy has established eight national computing hubs spanning 50,000 kilometers of ultra-high voltage transmission. Single projects like the Baihetan-Jiangsu link transmit 12 GW across 2,000 kilometers in 18 months from breaking ground to commercial operation. For comparison, the typical U.S. interstate transmission project requires 10-15 years and faces a coin-flip chance of completion.